Bullish Sandwich Candlestick Pattern Candle Stick Trading Pattern

A green (or white) candlestick indicates a bullish period closing higher than the open. A red (or black) candle is a bearish candle, closing lower than the open price. Image 24. Lines called "wicks" or "shadows" show the highs and lows and are positioned above and below the real body of the candle.

Bullish Sandwich Candlestick Pattern Candle Stick Trading Pattern

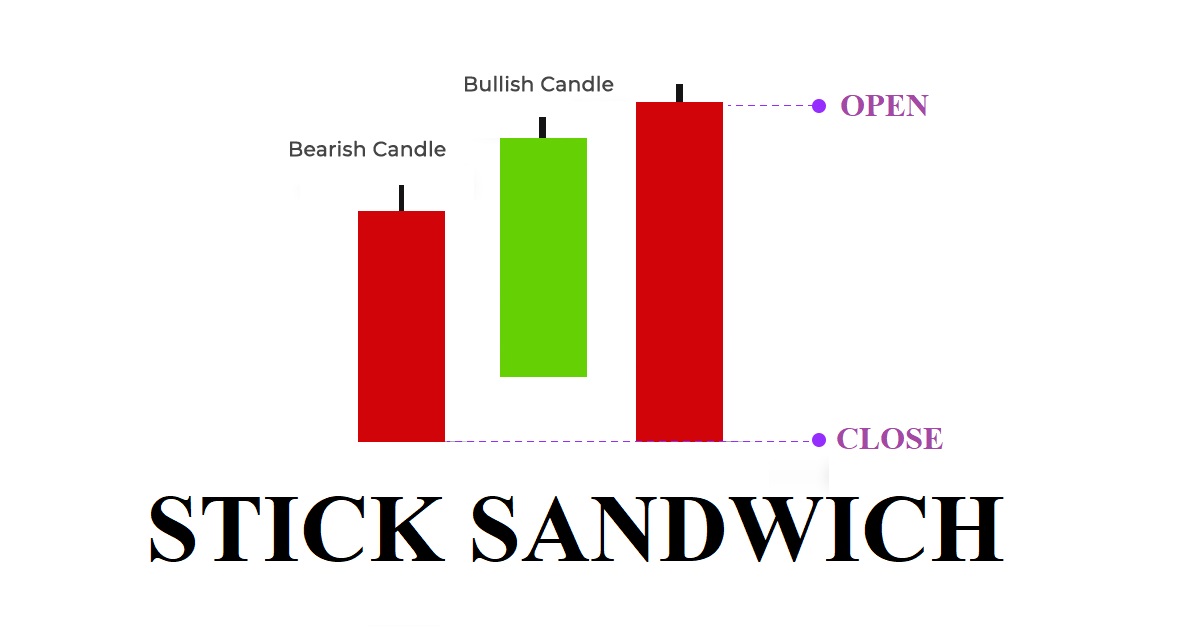

A stick sandwich is a 3-bar pattern. The closing prices of the two candlesticks that surround the opposite colored candlestick have to be the same. Statistics to prove if the Stick Sandwich pattern really works Are the odds of the Stick Sandwich pattern in your favor? How does the Stick Sandwich behave with a 2:1 target R/R ratio? Success rate

Bullish Stick Sandwich Candlestick Pattern (Backtest) Quantified

Pattern Requirements and Flexibility. The Bullish Stick Sandwich starts with a strong black candlestick, and a white candlestick that opens at the previous close or at a higher level follows it. The white body closes above the black body of the first day. The third day opens with an upside gap but closes exactly at the same level with the first.

Stick Sandwich candlestick pattern How to trade effectively with it

Jun 4, 2021 Written by: John McDowell Trading without candlestick patterns is a lot like flying in the night with no visibility. Sure, it is doable, but it requires special training and expertise. To that end, we'll be covering the fundamentals of candlestick charting in this tutorial.

Bullish Stick Sandwich Candlestick Pattern The Forex Geek

Trading the Stick Sandwich Candlestick Pattern — The Full Guide. Full Introduction and Back-test on the Stick Sandwich Pattern. Sofien Kaabar, CFA · Follow Published in Geek Culture ·.

:max_bytes(150000):strip_icc()/Clipboard01-9e16752263fe4f2a9f85182b9143b00f.jpg)

Stick Sandwich Definition

A stick sandwich trading pattern is a candlestick formation that's both bullish and bearish, and signals a reversion of the trend. Depending on whether the pattern is bullish or bearish, it will look a little different. In this article, we'll cover the bullish and bearish sandwich candlesticks.

Bullish Stick Sandwich Candlestick Patterns Forex Patterns YouTube

Bullish candlesticks indicate entry points for long trades, and can help predict when a downtrend is about to turn around to the upside. Here, we go over several examples of bullish.

Bullish Sandwich Candlestick Pattern Candle Stick Trading Pattern

Formed by three candles, the Stick Sandwich candlestick pattern can have both bullish and bearish implications, depending on the colors of the candlesticks. If you aren't quite ready to add this candlestick pattern to your menu, scroll down to learn what the Stick Sandwich looks like and what it means for interested investors.

Stick Sandwich Candlestick Pattern Hit & Run Candlesticks

A Stick Sandwich is a three-period pattern that involves a unique combination of bullish and bearish candles. Here's how to identify it: Period 1: A strong bearish candle appears where the closing price is significantly lower than the opening price.

Bullish Sandwich Candlestick Pattern Candle Stick Trading Pattern

The bearish Stick Sandwich pattern is composed of three candles with the first one a big bullish candle, the second one a bearish candle with a smaller body and the third one, a big bullish candle that closes below the highest high of the first two candles. On the third candle, a bearish signal is generated.

Bullish Stick Sandwich Candlestick Pattern The Forex Geek

A stick sandwich is a technical trading pattern in which three candlesticks form what appears to resemble a sandwich on a trader's screen. Stick sandwiches will have the middle.

:max_bytes(150000):strip_icc()/dotdash-INV-final-Stick-Sandwich-Mar-2021-01-0c123474b86a42528a609eb08d5f3700.jpg)

Stick Sandwich Pattern What it is, How it Works

A bullish Stick Sandwich will run "black-white-black" or "red-green-red". The candles on each side must have larger trading ranges than the middle candle, making them taller than the middle candle. The middle candle must be shorter so that it is engulfed by the first and third candle.

Stick Sandwich candlestick pattern PatternsWizard

1. The Hammer If you are familiar with the bearish "Hanging Man", you'll notice that the Hammer looks very similar. But as the saying goes, context is everything. Much like the Hanging Man, the Hammer is a bullish candlestick reversal candle. The context is a steady or oversold downtrend.

:max_bytes(150000):strip_icc()/UsingBullishCandlestickPatternsToBuyStocks1-ac08e48665894dbfa263e247e53ba04e.png)

Using Bullish Candlestick Patterns To Buy Stocks

The bullish stick sandwich is a rare candlestick pattern. The first candlestick in the formation is a long black (red) candlestick that closes near its low. The second candlestick is a white (green) candlestick that gaps up from the previous close and closes above the previous day's open.

Using 5 Bullish Candlestick Patterns To Buy Stocks

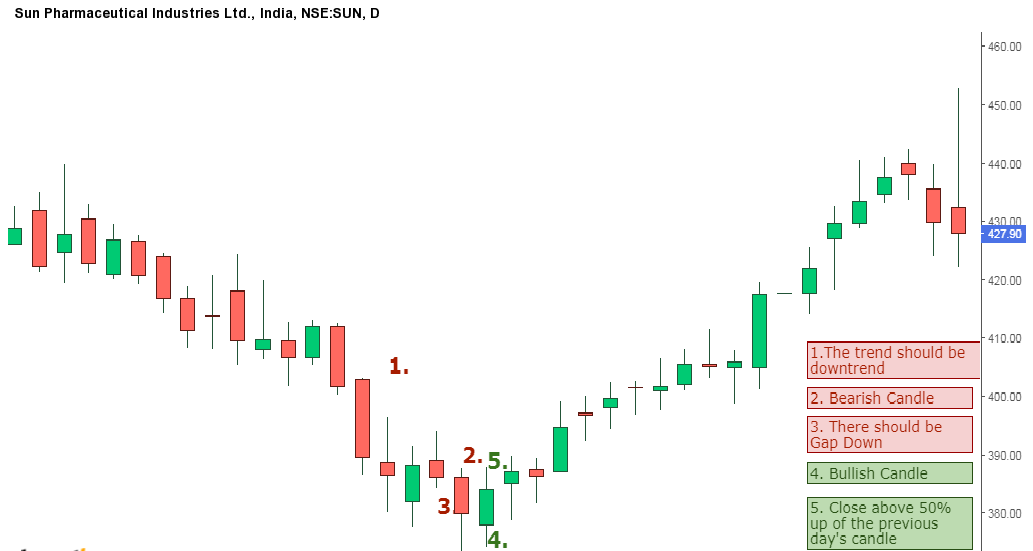

Stick Sandwich is a bullish trend reversal candlestick pattern consisting of three candles. The Stick Sandwich candlestick pattern is recognized if: The first candle is bearish and continues the downtrend; The second candle is bullish and its Open price is higher than the first candle's Close price;

1 Guide to recognise a Stick Sandwich pattern on IQ Option. A good way

The stick sandwich appeared on Akamai's (AKAM) daily chart on September 18th, 2002. The price is in a bearish trend as it's below the fifty-day moving average. The first candle is bearish. The second candle is bullish and only trades above the previous candle's close. The third candle is bearish with a close equal to the first, fulfilling.